Tax Guide 2014 South Africa

Individuals under 65 R 23,800 per annum Individuals over 65 R 34,500 per annum Special rules apply to foreign interest (interest earned on bank account outside South Africa) as well as to individuals who are not tax resident in South Africa. Foreign interest is only exempt for the first R3,700 and this R3,700 must first be used to exempt foreign dividends.

Workshop manual for ford focus mk3. Sep 19, 2018 - Finally [PDF] Ford Focus Mk3 Repair Manual PDF is available at our online library. With our complete resources, you could find [PDF]. Haynes Publishing provide manuals for a wide range of Ford models. Some of the most popular models include the F-250, Escort, Focus, Taurus and the. FACTORY WORKSHOP SERVICE REPAIR MANUAL FORD FOCUS MK3, RS 2010. *WORKSHOP MANUAL SERVICE & REPAIR GUIDE for BMW X3 F25. HAYNES REPAIR AND SERVICE MANUAL FOR: FORD FOCUS; 2011 to 2014 (uk 60 Reg to 14 Reg); THE MANUAL COVERS STANDARD TRANSMISSIONS,. IWe use cookies to provide you with a better service. Carry on browsing if you are happy with this, or find out how to manage cookies. Close cookies bar.

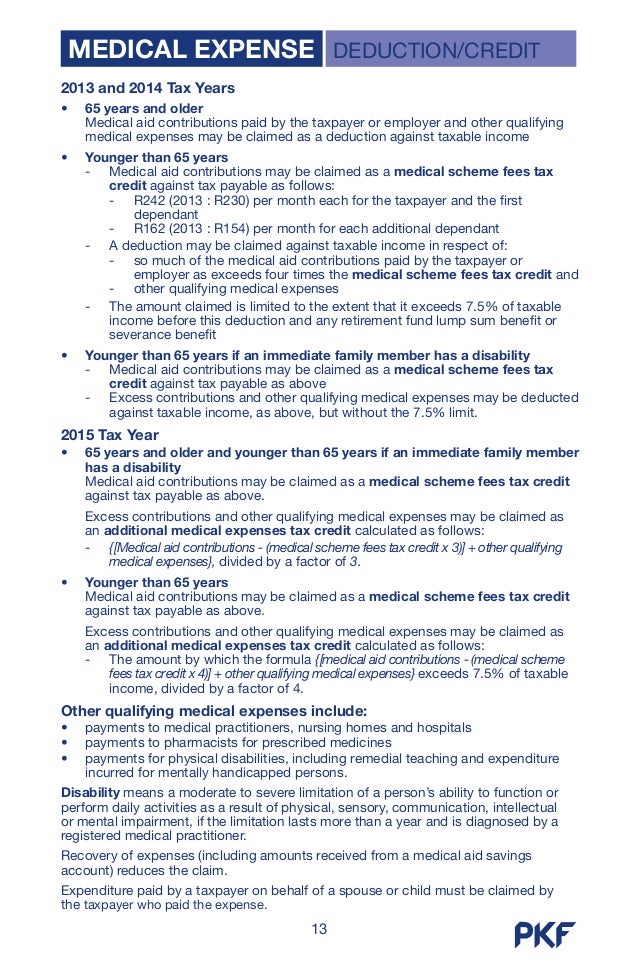

See below for non-residents. Interest is exempt where earned by non-residents who are physically absent from South Africa for at least 182 days during the 12 month period before the interest accrues or is received and who were not carrying on business in South Africa through a fixed place of business during that period of 12 months. From 1 January 2015 the debt from which the interest arises must not be effectively connected to a fixed place of business in South Africa. Dividends Tax Dividends tax is imposed at 15% from 1 April 2012 on dividends declared and paid by resident companies and by non-resident companies in respect of shares listed on the JSE. Dividends are tax exempt if the beneficial owner of the dividend is a South African company, retirement fund or other exempt person. The tax is to be withheld by companies paying the taxable dividends or by regulated intermediaries in the case of dividends on listed shares. Effective 1 March 2013 the medical scheme fees tax credit system will be as follows;.

A medical scheme contribution tax credit will be available to taxpayers who belong to a medical scheme and are below the age of 65 (including persons with a disability), set at fixed amounts per month:. R 257 per month for contributions made by the taxpayer and R 242 for the first dependant; plus. R 172 per month in respect of each additional dependant. See for the more detailed rules. The fringe benefit that will be added to an employee for the private usage of a business vehicle is 3.5% of the determined value of the vehicle.

Where the vehicle is the subject of a maintenance plan at the time that the employer acquire the vehicle the taxable value is 3.25% of the determined value. Where the distance travelled for business purposes does not exceed 8000 kilometres per annum, no tax is payable on an allowance paid by an employer to an employee up to the rate of 330 cents per kilometer, regardless of the value of the vehicle. This alternative is not available for other compensation in the form of an allowance or reimbursement is received from the employer in respect of the vehicle. 80% of the travelling allowance must be included in the employee’s remuneration for the purposes of calculating PAYE. The percentage is reduced to 20% if the employer is satisfied that at least 80% of the use of the motor vehicle for the tax year will be for business purposes. No fuel cost may be claimed if the employee has not borne the full cost of fuel used in the vehicle and no maintenance cost may be claimed if the employee has not borne the full cost of maintaining the vehicle (e.g.

If the vehicle is covered by a maintenance plan). The fixed cost must be reduced on a pro-rata basis if the vehicle is used for business purposes for less than a full year. The actual distance travelled during a tax year and the distance travelled for business purposes substantiated by a log book are used to determine the costs which may be claimed against a travelling allowance. Alternatively: Where the distance travelled for business purposes does not exceed 8 000 kilometres per annum, no tax is payable on an allowance paid by an employer to an employee up to the rate of 330 cents per kilometre, regardless of the value of the vehicle.

This alternative is not available if other compensation in the form of an allowance or reimbursement (other than for parking or toll fees) is received from the employer in respect of the vehicle. Subsistence may be claimed where an employee with his normal home in South Africa spends a night away from home on business for the employer. Where a subsistence allowance is paid there is no PAYE deduction on the amount. Certain deemed amounts are expended on such business trips. It must be remembered that these deemed amounts are only claimable where an employer actually pays an employee a subsistence allowance.

Travel Guide South Africa

The deemed claims are limited to the amount of subsistence allowance paid. These deemed amounts were updated and with effect from March 2013:. Travel outside South Africa: This is determined on a country-to-country basis. This is determined on a country-to-country basis. SARS has the comprehensive list of countries and the daily rates on its website (www.sars.gov.za).

Travel in South Africa: R 335 per day for meals and incidentals. Travel in South Africa: R 103 per day for incidentals only. Every employer in South Africa must withhold PAYE (Pay-as-you-earn) from remuneration paid to an employee. The rate of withholding is determined by the South African Revenue Service and is published in their EMP10 Guidelines.

Tax withheld must be paid on or before the 7th day after the month in which remuneration was paid. It is the employer’s obligation to ensure the correct withholding of PAYE.

Where an employer has not withheld the correct amount, it becomes a debt to the South African Revenue Service. When audited, employers often find their tax exposures to be very large and SARS is on a drive to audit all employers. At the end of a tax year the employer must report the PAYE to SARS on an IRP501 form. This form shows what PAYE was withheld per employee. The income and benefits paid to an employee and the PAYE withheld is also shown on an IRP5 certificate that is handed to the employee. This document is filed by the employee with his or her personal income tax return.

Employees’ tax is a complex area and specific questions will be easier to answer than attempting to do the topic justice with a more detailed explanation. The residency test is very important for any foreigner coming to South Africa or for any South African going abroad. The reasons being primarily that:. When you are resident of South Africa you pay tax on your worldwide income and as a non-resident you only pay tax on your South African “source” income and certain beneficial exemptions apply; and. When you loose your South African tax residency, for instance you go work abroad and your circumstances dictate that you become non-resident, there is a deemed disposal of certain of your assets for capital gains tax purposes and this may cause some cash flow problems. An individual will be tax resident in South Africa by applying the following tests: Firstly, you will never be tax resident in South Africa should you be tax resident, in terms of a double tax agreement entered between South Africa and a tax treaty partner, in the partner country.

An example will be where you go and work in the United Kingdom and you become a full tax resident there while you do not have available accommodation in South Africa. The double tax treaty between South Africa and the United Kingdom will then determine that you are exclusively resident in the United Kingdom and the result is that you become non-resident for South African tax purposes. Provided the above does not apply, you will be South African tax resident as long as you are “ordinarily resident” in South Africa.

The meaning of “ordinarily resident” is that you consider South Africa your real home and plan to return to South Africa. This is the reason why many South Africans overseas remain “ordinarily resident” in South Africa and also the reason why foreign workers coming to South Africa on expatriate assignments ever become “ordinarily resident”.

When you are not treaty resident in another country and you are not “ordinarily resident” in South Africa, it is still possible for you to be tax resident because of a days test. The test determines whether you are tax resident in South Africa for a particular year of assessment and has two legs:. You are resident if you are, measured over six tax years, more than 91 days in of each of these years in South Africa; and. In the first five of these six years, you are more than 915 days in South Africa Should the test be met you will be tax resident in South Africa for the sixth tax year. The South African Revenue Service now asks specific questions to the above effect in your personal income tax return and has become a lot more aware and active in enforcing the residency tests. Foreign tax credits are generally given where a South African tax resident is taxed on income that has already been taxed in another country under a source principle and where any double tax agreement between South Africa and that other country allows that country to tax the income. We will therefore not give tax credits where we have the right to first collect tax on income.

This is pretty standard in all tax systems internationally. The amount of credit must be claimed in an individual’s income tax return and the amount of credit given is limited to tax on the income being taxed twice. This ensures that tax credits can never be claimed against income that South Africa has the exclusive taxing right on. Exemptions however do exist. Please contact us for details.

South African resident taxpayers who work abroad still need to declare their foreign income in their individual income tax returns. This income can however be exempted from South African tax by claiming a tax exemption where certain conditions of absence have been met. These conditions are:. It must be employment income; and.

The income must be earned while you were working outside South Africa; and. The time that you must have been outside South Africa on work must be more than 183 days in any 365 day period and of this 183 days 60 days of absence must have been continuous; and. The income must become taxable in your hands during the 365 days referred to in the previous point. This is an important exemption and South Africans working abroad must plan the effect hereof carefully to ensure that they qualify for the exemption. When you are reading this section when you have to calculate estate duty it is probably too late. Estate duty should be planned well before death.

The rate is 20% of the amount determined by the Act as subject to estate duty. There are various exemptions such as everything that goes to a surviving spouse. Whatever remains is subject to a standard exemption of R3.5 million per estate. Estate duty is levied at a flat rate of 20%. The following exemptions apply- All property accruing to a surviving spouse (known as the estate duty roll-over) and any claim arising out of the Matrimonial Properties Act. The first R 30,000 of an individual taxpayer’s capital gains for a tax year is exempt from capital gains tax.

In year of death, this amount is increased to R300,000. First R 600,000 of cost of immovable property 0% R 600,001 to R 1,000,000 3% of the value above R 600,000 R 1,000,001 to R 1,500,000 R12,000 plus 5% of the value above R 1,000,000 R 1,500,001 and above R 37,000 plus 8% of the value exceeding R 1,500,000 Transfer duty is paid where immovable property is acquired and the transaction is not subject to VAT. It also now applies to where the rights of ownership are transferred to immovable property where a company, close corporation or trusts are involved.

If a registered vendor purchases property from a non-vendor, the VAT notional input tax credit is limited to the VAT fraction (14/114) of the lower of the selling price or the open market value. A notional input tax credit is only claimable to the extent to which the purchase price has been paid and the property is registered in the Deeds Office; With effective date of 10 January 2012, the restriction that the notional input is limited to the transfer duty paid is no longer applicable; and Persons attempting to evade transfer duty may be charged with an additional duty of up to double the amount of duty that was originally payable. The person will also be guilty of an offence and liable upon conviction to either a fine, or imprisonment, for a period not exceeding sixty months.

Tax rebates 2014 R Primary – all natural persons 12 080 Secondary – persons aged 65 and older 6 750 Secondary – persons aged 75 and above 2 250 Tax Thresholds Below age 65 – R67 111 65 to below 75 – R104 611 Age 75 and over – R117 111 Trusts The tax rate on trusts (other than special trusts which are taxed at rates applicable to individuals) remains unchanged at 40%. PROVISIONAL TAX A provisional taxpayer is any person who earns income other than remuneration or an allowance or advance payable by the person’s principal. The following individuals are exempt from the payment of provisional tax–. Individuals below the age of 65 who do not carry on a business and whose taxable income –. will not exceed the tax threshold for the tax year; or.

from interest, foreign dividends and rental will be R20 000 or less for the tax year. Individuals age 65 and older if their taxable income for the tax year –.

consists exclusively of remuneration, interest, foreign dividends or rent from the letting of fixed property; and. is R120 000 or less. A provisional tax return showing an estimation of total taxable income for the year of assessment is only to be submitted if the Commissioner for SARS so requires. Retirement fund lump sum withdrawal benefits Taxable income Rate of tax R R 0 – 22 500 0% of taxable income 22 501 – 600 000 18% of taxable income above 22 500 600 001 – 900 000 103 950 + 27% of taxable income above 600 000 900 001 and above 184 950 + 36% of taxable income above 900 000 Retirement fund lump sum withdrawal benefits consist of lump sums from a pension, pension preservation, provident, provident preservation or retirement annuity fund on withdrawal (including assignment in terms of a divorce order). The big day is here. SA Tax Guide is celebrating 5 years. Thank you for being part of our journey as we share taxation information in a simplified & demystified way.

Latest Tax News. Categories. (36). (42).

(33). (42). (13). (19).

(55). (44). (183). (234). (17).

(59). (18). (9). (5). (18).

(163). (341). (198). (87). (8).

(12). (18). (9). (6).

(1). (127). (51).

South Africa Tax Rate

(19). (7). (44). (67). (50).

(57). (289). (11). (169).

(63). (10). (40).

(43). (143). (137). (6).

Pkf Tax Guide 2015 South Africa

(9). (25) Archives Archives.